Money things

Long-term travel budgeting

As Bret and I were planning this trip, we had several conversations about how exclusionary travel can seem from a financial perspective. In fact we ourselves never would have thought this type of trip was possible had we not known people who did it and were willing to share in-depth information on their budget! Once you go down the rabbit hole, there are great resources and books. Of course, there’s a certain level of privilege involved in any travel. That being said, we found it can be so much more accessible than it appears amid luxury travel accounts and glossy jet setter magazines. On this trip, we’ll be doing a fair amount of budget-friendly travel and hope to showcase that for anyone who’s dreaming of travel but not sure how to make it happen.

Based on 2022 prices, expert travelers suggest a solo-traveler could spend a year trekking around the world for between $20,000-$25,000, or between $1,700 and $2,000 a month. We’re planning to spend a few months traveling. For us, that meant pricing out what our itinerary will cost and making a budget. We also planned for storage of our things while we travel and made sure we have a nest egg of money we can live off of when we return and some additional long-term/emergency savings.

We will be staying mostly in Airbnbs and lower price point options, taking advantage of free walking tours and finding cost effective ways to experience places. We have built in some extra funds for certain excursions we’d like to do along the way. For example: museum visits in Paris, a tour of Wadi Rum and Petra in Jordan and maybe a splurge hotel or two along the way. As we travel to each location, I’m hoping to add a daily spend total to each destination guide.

Travel credit cards

We’ve been able to build-up travel points totaling several thousand dollars that will help cover some trip expenses. Two of the cards we got are both from Capital One. We found their travel booking site is easy to use and has a pretty comprehensive set of options for flights, hotels, etc. They also price match and offer bonus points for booking through their site. You do also have the option to redeem the points in the form of a credit to your account, if don’t book directly through Capital One. Some cards that are tied to specific hotel brands or carriers (like the Southwest Card) do have a higher redemption rate, but we like that you can use these points on virtually anything.

Capital One Venture Rewards - this card has a lower annual fee. There’s a bonus miles incentive if you spend a certain amount in the first few months. You get a $100 credit for TSA PreCheck/Global Entry. There are also no foreign transaction fees and as of this writing you get two visits to Capital One Lounges annually.

Capital One Venture X - this card has a higher annual fee but also comes with bigger perks. There’s a sizeable bonus miles promotion, you get a $300 annual travel credit, 10,000 anniversary points ($100) and a $100 credit towards TSA PreCheck/Global Entry. You also get access to Capital One Lounges with this card and Priority Pass access to another “1,300+ participating VIP lounges, in more than 600 cities and more than 148 countries”. We’ve found the lounge access to be a great way to save money in airports, because you are able to eat and drink at the lounge.

In addition to the Capital One cards, we were able to take advantage of some airline and hotel specific cards. The Delta SkyMiles American Express card allowed us to get a $300 statement credit on our international airfare. The Chase Marriott Bonvoy Boundless card will provide 3 free night stays at a Marriott Property during our travels.

Insurance

This was one of the most-researched items on our travel list. We decided to go with WorldNomads for our travel insurance covering overseas medical needs and trip issues. It’s important to know, most travel insurance companies don’t cover you back in the U.S. We got additional health care coverage for that.

Cell Phones

Many carriers have the option to tack-on an international plan for a monthly rate of $100, allowing you to keep using your phone as normal. A more cost-effective option is foregoing the international plan, avoiding using data and simply relying on WiFi. This is what we’ll be doing. We won’t be able to use mapping apps in real time. Bret discovered an app called Here We Go, which allows you to download full city maps and use them for navigating even when you’re not connected to WiFi.

Tracking Spending

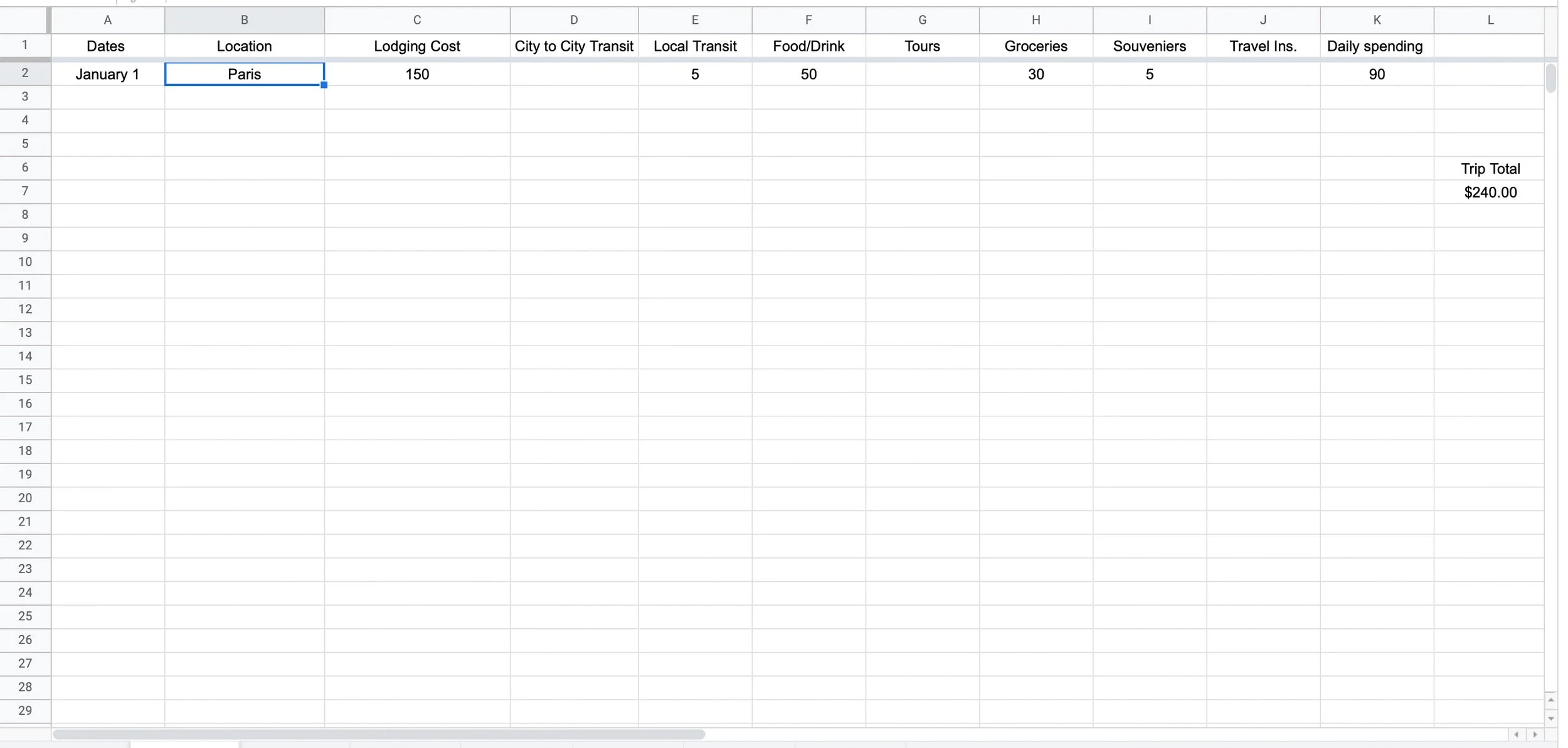

We’ll be tracking our spending in a Google sheet that Bret set up (he’s the Excel/Sheets expert). We’re planning to enter in the cost of travel between destinations plus local transit, each day’s lodging cost, plus daily spending on food/drinks, tours, souvenirs/gifts and groceries/toiletry items. All of it will auto calculate into our total trip spend, so we can stay aware of the overall cost as we’re traveling. Bret also set it up so there’s a daily spending tab that will calculate the total for local transit, food/drinks, tours, souvenirs and groceries/toiletries on each day.

We’re hoping to give a detailed budget break-down of each country, including our average daily spending. We’ve found that incredibly helpful from other friends and travelers!

Our plan is to sit down each day and enter daily spending so we stay on top of it. Here’s an example of the blank Google sheet: